Do you know what is driving your firm's enterprise value?

Whether you are looking to merge your practice, admit a new equity owner or just want to know what your enterprise value is, our certified valuation experts can accurately assess the value of your business while identifying strategic opportunities to increase your future valuations.

We provide insightful, customized valuations that empower firms to make informed decisions to build enduring firms. Because we do not set the deal price or execute the transaction, we let the data speak for itself when determining a firm's value. In order to do so, we use a variety of valuation approaches included Discounted Cash Flow, Income-Based Approach, and Market Approach.

➡️ Learn more about the 10 Drivers of Enterprise Value

Our Services

-

Designed for firm’s who have received a valuation from another provider but are looking for a second opinion

-

Includes a custom analysis and recommendations based on findings

-

Used for tracking enterprise value, peer benchmarking, and internal transactions where bank financing is not needed

-

Includes financial modeling, enterprise value scorecard, and a custom executive summary with coaching objectives

-

Available as an annual subscription

-

Used for acquisitions, lending, ensemble formation, equity sale, litigation, or charitable donation

-

Necessary for bank financing and IRS reporting

-

Meets the Uniform Standard for Professional Appraisal Practice (USPAP)

-

Includes an economic analysis, industry analysis, and custom firm report

-

Available as an annual subscription

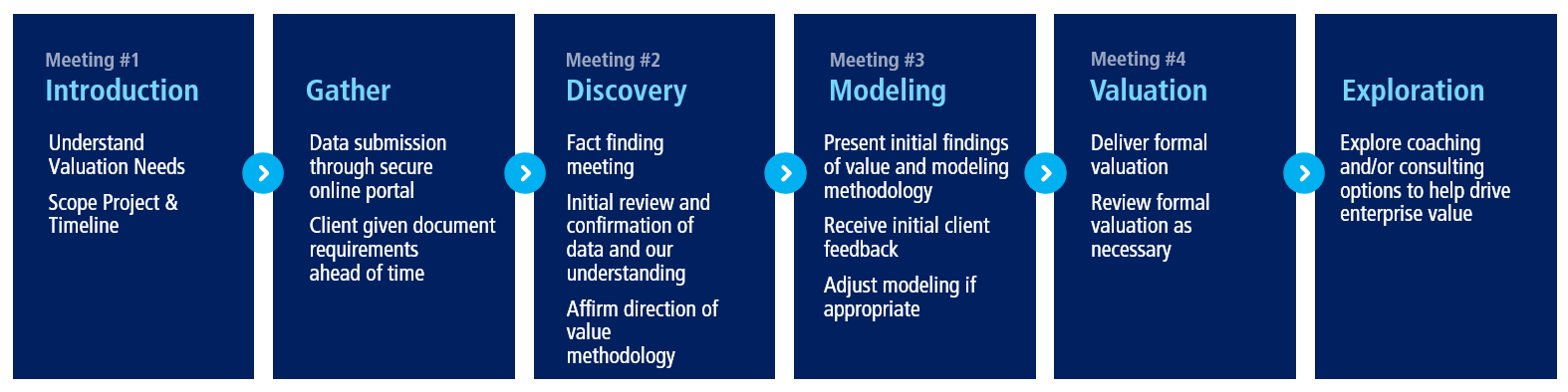

The Process

Key Benefits

Enterprise Value Scorecard

A custom scorecard so you know what is driving your enterprise value and where to focus your firm's strategic efforts.

Financial Models

Receive over 20 sets of financial models so you can use data to shape your firm’s goals and objectives.

Coaching Objectives

Using the Professional Advisor Model™, each report contains custom coaching objectives for you to implement within your firm.

Customized Reports

Each report contains a detailed custom company analysis that is unique to your firm.

Personalized Consultation

Meet with our valuation experts to understand the unique drivers of your firm.

Robust Data

Use data to make informed decisions about the future of your firm. We analyze everything from financial projections to the investment of labor.

Unbiased Opinions

Because we are not deal makers, we look at only what the data and facts tell us.

Firm Type Agnostic

We have extensive experience conducting valuations for every type of practice including RIA, IAR, RR, OSJ, and Insurance.

"The ClientWise Team has been invaluable in helping us think through many of the issues around valuation, allocation of resources, and clarity on what the financial standing of our firm allows us to do both now and in the future. They've also helped us understand the levers we can pull to accelerate the growth of the firm and future valuations." Steven Miura, The Miura Group

Questions Financial Advisors Often Ask

-

A Registered Investment Advisor (RIA) or wealth management firm is typically valued using a combination of income-based and market-based approaches.Analysts evaluate recurring revenue quality, EBITDA, growth trends, profitability, client demographics, revenue concentration, leadership depth, and succession readiness.

Valuation multiples alone do not determine value. Risk profile, scalability, and founder dependency significantly influence enterprise value.

-

Enterprise value is most influenced by:

- Organic growth rate

- Recurring revenue quality

- Profitability and EBITDA margins

- Client demographics and retention

- Revenue concentration risk

- Leadership depth and succession readiness

- Founder dependency

A formal valuation evaluates how these drivers interact to determine defensible value.

➡️ Learn more about the 10 Drivers of Enterprise Value

-

Financial advisory firms may trade at EBITDA multiples or revenue multiples, depending on structure and profitability.

However, published “average multiples” can be misleading. Actual valuation depends on:

- Growth rate

- Profit margins

- Recurring revenue stability

- Client concentration

- Leadership continuity

- Market conditions

Two firms with similar revenue can have materially different enterprise values.

-

The value of your firm depends on revenue quality, profitability, growth trajectory, client demographics, leadership structure, and succession planning.

A valuation calculator can provide a directional estimate. A formal valuation provides detailed financial analysis, risk assessment, and documentation required for transactions, financing, and compliance.

-

ClientWise performs valuations for:

- Mergers and acquisitions (M&A)

- Partner buy-ins and buyouts

- Succession planning

- Internal ownership transitions

- Gift and estate planning

- Equity incentive programs

- Litigation support

- Financial reporting and compliance

Each valuation is tailored to its specific purpose and regulatory requirements.

-

We offer three types of reports:

Second Opinion Valuation

An independent review of an existing valuation.Limited-Use Valuation Report

Used for enterprise value tracking, peer benchmarking, and internal transactions where bank financing is not required. Includes financial modeling, an Enterprise Value Scorecard, and a strategic executive summary.

Available as an annual subscription.Comprehensive Valuation Report

Required for acquisitions, lending, equity sales, litigation, charitable donations, and IRS reporting. Includes full documentation and defensible valuation methodology.

Available as an annual subscription. -

Most firms benefit from a valuation every 12–24 months.

An updated valuation is recommended sooner if there are material changes in revenue, profitability, ownership structure, leadership, market conditions, or strategic direction.

Regular valuations allow firms to track enterprise value over time and prepare for succession or liquidity events.

-

Timing depends on complexity and report type. A limited-use valuation may take several weeks. A comprehensive valuation for transactions or lending may require additional time for detailed financial analysis and documentation.

-

Increasing enterprise value requires improving growth consistency, profitability, leadership depth, succession planning, and operational scalability.

Our valuation process identifies the specific drivers impacting your firm’s value and highlights where strategic improvements will have the greatest impact. Many firms continue working with ClientWise through coaching and M&A advisory to intentionally increase enterprise value over time.

ClientWise is an approved valuation partner for Live Oak Bank. Live Oak offers lines of credit, express, and general-purpose loans from $10K to $100MM for various needs, including internal stock purchase, acquisition facilities and commercial real estate. Learn more at liveoakbank.com/ia

Let us guide you to your potential.

Connect with us to problem solve for a successful future.

.png?width=771&height=215&name=wintrustagentfinance-black%20(002).png)